The big factory has issued an early warning, and the chip delivery time has been shortened again. Is the tide of chip surplus really coming?

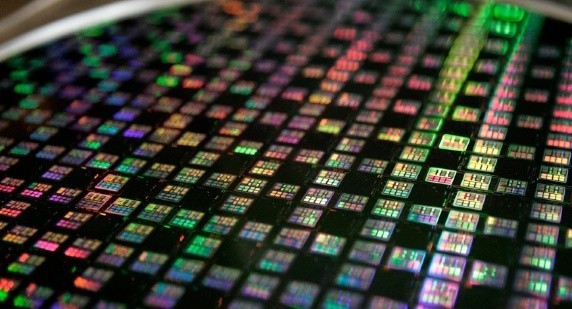

(The picture comes from the Internet)

Trapped by weak industry demand, the recent financial reports released by major manufacturers such as Intel, Nvidia, and AMD are not as good as expected. In addition, the media reported that the chip delivery period has been shortening in recent months, and the industry's chip surplus has resurfaced.

1. The big factory issued an early warning and the performance expectations were poor

Intel's financial report data shows that in the second quarter, revenue was 15.3 billion US dollars, a year-on-year decrease of 17%, and a net loss of 500 million US dollars. At the same time, Intel also lowered its full-year forecast from US$76 billion to US$65 billion to US$68 billion, far below the market expectation of US$74.76 billion.

The company's quarterly report showed its first quarterly loss in nearly 30 years and said it had to cut its full-year forecast due to poor performance in its PC and server chip divisions.

In early August, Nvidia said in a statement that it expected its total revenue in the second quarter to be $6.7 billion, a significant “shrink” of more than $1 billion compared with the company’s initial forecast of $8.1 billion in its guidance.

In its latest earnings forecast, Nvidia warned that macroeconomic conditions are expected to continue to weigh on sales in the near term, but stressed that the company's long-term growth and earnings outlook will remain unchanged.

AMD, the industry decline is smaller, but the company issued a bleak performance forecast, indicating that it is not optimistic about the demand for PCs in the third quarter.

According to the financial report data, AMD’s revenue in the second quarter was US$6.550 billion, an increase of 70% over the same period; its net profit was US$447 million, a decrease of 37% over the same period. AMD expects revenue growth in the third quarter to slow significantly from at least 70% in the first and second quarters. Operating income in the third quarter is expected to be $6.7 billion, plus or minus $200 million, an increase of about 55% year-on-year, which is lower than industry expectations.

2. Chip delivery times are shortening

Chip lead times are shrinking, but shortages persist in many areas, according to Bloomberg.

Lead times, or the time difference between semiconductor ordering and delivery, were 27 weeks in April, 27.1 weeks in May, 27 weeks on average in June and 26.9 weeks in July, Susquehanna Financial Group said. Delivery times have been shortened for three consecutive months.

While overall metrics have improved, supplies of power management components and microcontrollers, especially chips needed by automakers and industrial equipment makers, remain tight. For example, lead times for power management chips increased from 31.3 weeks in June to 32 weeks in July. In addition, some product prices are still rising.

Susquehanna pointed out that declining demand in some areas of the semiconductor industry, especially components used in personal computers and smartphones, has yet to translate into a complete end to the chip shortage. "Overall lead times are still more than double that of the 'healthy' market," he said.

Parts of materials of this site come from the internet, please contact if there is infringement